12 novembre 2008

"GfK GeoMarketing’s real estate specialists recently researched Europe’s

commercial real estate market. Large-scale projects such as shopping centers

are currently – and will continue to be – major contributors to Europe’s

retail growth.

The research revealed significant differences between Europe’s well

developed markets and the emergent markets in Central and Eastern Europe.

For example, in countries such as Germany, Belgium and Denmark, the sales

area per inhabitant offering is around 1.3 to 1.4 m², or even as high as 1.6

m² in the Netherlands and Austria.

Slovenia, Poland and Hungary lead the pack among the emergent markets in

Central and Eastern Europe. The sales area per inhabitant offering in these

countries is just under 1 m². This impressive performance is mostly due to

large-scale retail formats such as hypermarkets, retail parks and shopping

centers. The leading countries in this group have already surpassed Greece,

the country with the lowest sales area per inhabitant offering in “old

Europe”.

The comparatively lower sales area per inhabitant offering in Europe’s

emergent markets does not mean there is demand for additional sales area in

these locations. This is because the retail boom in these countries is

largely confined to the major cities, some of which already show signs of

overstoring. The rush of retailers, developers and investors has meant that

careful location planning, risk assessment and efforts to ensure long-term

sustainability have been neglected. Some retail locations with less than

ideal sites and problematic branch and tenant mixes have already had to be

completely refurbished. Additional retail locations will meet this same fate

in the near future.

Shopping centers, the most successful phenomenon on the retail real estate

scene, continue to grow in importance; however, their current relevance and

degree of market presence varies significantly by country. They are well

established in western European countries, although their growth percentage

appears relatively modest amidst the overall climate of market saturation.

The shopping center sales area per inhabitant offering differs by country,

with 100 m² per 1,000 inhabitants available in Germany and 200 m² per 1,000

inhabitants in Spain.

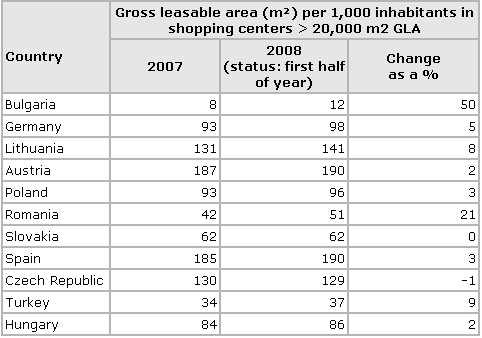

Per capita sales area offered by shopping centers (in excess of 20,000 m²

GLA) in selected European countries

Source: GfK GeoMarketing, 2008

The emergent markets in Central and Eastern Europe are also quickly catching

up with regard to shopping center offerings. Following the collapse of

socialism, many of the metropolitan areas in these countries did not adopt

the western model of small-scale, inner-city retail development – the

so-called “High Street” retail environment. Rather, these areas have focused

almost exclusively on large-scale shopping centers.

As a result of this trend, the sales area offerings of shopping centers in

the Baltic states, the Czech Republic and Poland are comparable to the

European average.

“The demand for shopping centers in Central and Eastern Europe is always

initially concentrated in the well-known metropolitan areas. Later, though,

demand expands to secondary and other mid-sized cities,” explains Olaf

Petersen, head of GfK GeoMarketing’s Real Estate Consulting division.

“Although there are numerous opportunities associated with this development,

there is also the risk that careful planning will be neglected amidst the

dynamic growth environment. Merely building a shopping center does not

guarantee its success. Naturally, shopping centers can be positioned more

easily in emergent markets than in highly developed ones. However, the first

warning signs and problems surrounding shopping centers are becoming

apparent in the Baltic states, Turkey and Bulgaria. In short, there are

currently many project locations and concepts that would be best avoided.”

“The solid economic growth in these countries is not a cure-all. While it

may be costly but not necessarily financially fatal to establish a

supermarket that then fails, shopping center endeavors are less forgiving.

Thus, the significant funds required to establish a shopping center should

be preceded by a thorough due diligence study – i.e., a professional

assessment of a given project’s likelihood for success with regard to all

relevant criteria. Well conceived shopping center projects whose intended

locations have been intensively researched are still great investments.” (CS

della Società)