di Thomas Beyerle

Let’s not fool ourselves: the fact that the transport, traffic, and logistics industry will continue to be systemically important is becoming clear to many people these days with a view to the geopolitical situation. The interruption and rerouting of transport flows will lead to a short-term increase in storage capacity, which already was a lesson from the first Covid year 2020. The focus here will be less on the “last mile” and more on the “nearshoring” functions. In sober economic language, this means: “Logistics will continue to be a dynamic growth market”.

At this point, however, a “but” must also be included in the analysis, because the first risk premiums from financiers for project developments in this segment and the basic risk adjustment to the political-economic situation will put the multipliers or returns under pressure.

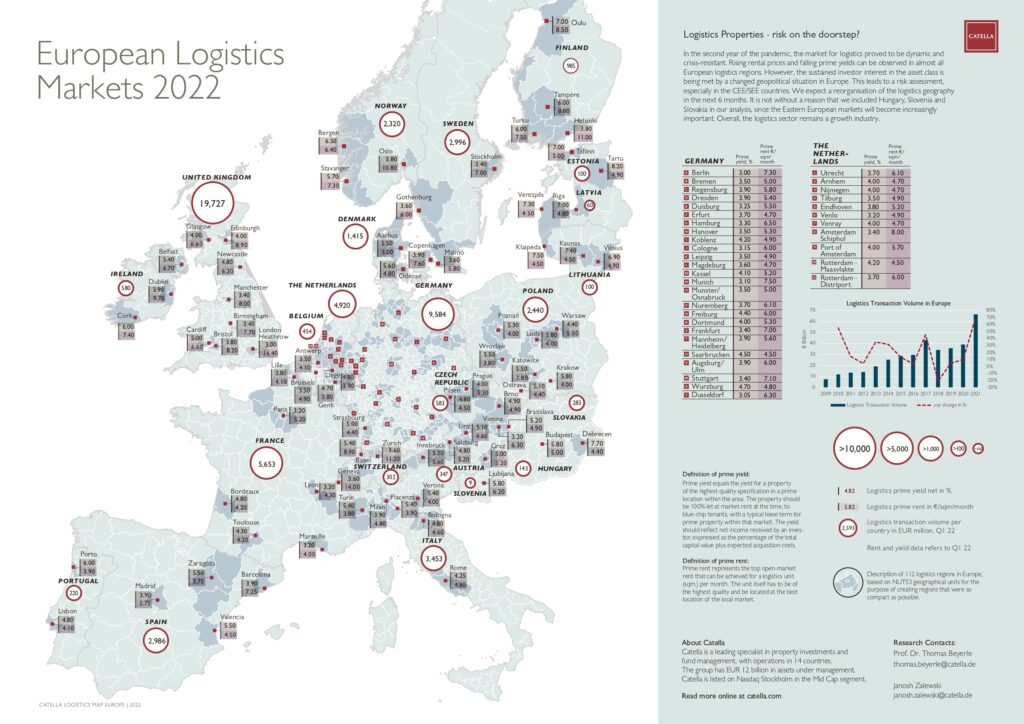

Our forecast for autumn 2022 shows a new yield landscape in parts of Europe. Currently we would like to give you an overview of the first quarter of 2022 and the expectations for the logistics markets in Europe – as always in a comparative overview, with a total of 112 regions.

– The current European prime rent averages €5.81/sqm, ranging from €3.75/sqm in Zaragoza to €16.40/sqm in London. Since our last market overview in October 2021, prime rents for logistics have risen by an average of almost 3% across all 112 markets surveyed.

– The increases were particularly significant in Eindhoven (+18%), Venlo (+17%), Brussels (+9%), Strasbourg (+10%), Bologna (+10%) and Prague (+8%).

– Due to the sustained investor interest in the logistics segment, yield compression can be observed across all markets. The European average yield is now 4.68% which is 30 basis point lower compared to the analysis 6 months ago.

– The lowest net initial yields, which speak for the most expensive logistics locations in Europe, can be found in the German A locations (3.00%-3.40%) as well as in Venlo (3.20%), Paris (3.20%) and London (3.00%). It seems to be only a matter of time before the prime yield in the top locations falls below the 3% mark.

– The current strong demand for logistics properties can also be seen in the transaction volume within the individual countries. For example, a logistics transaction volume of 9.6 billion euros was recorded in Germany and a volume of 19.7 billion euros in the United Kingdom, which represents a record value in both cases.

– In total, an investment volume of almost 60 billion euros was recorded across the markets surveyed, which also represents a new record transaction volume at the European level.

Nevertheless, the market for logistics real estate will oscillate between further very dynamic growth and increased risk provisioning on the part of investors in the coming months.

Le mie ricette per la real estate community

Le mie ricette per la real estate community