In a tough trading environment, retail markets across Europe have been affected in varying degrees by the direct and indirect impacts of price increases that are being driven by shortages of raw materials and higher energy costs and amplified by the war in Ukraine, which has now been raging for more than six months. Retail markets in Poland and in Southern European countries have proved to be relatively robust during the crisis, with Portugal even seeing positive growth. However, the effects on consumer confidence and retail activity in other parts of Europe are clearly apparent in the Global Retail Attractiveness Index (GRAI) compiled by Union Investment and GfK.

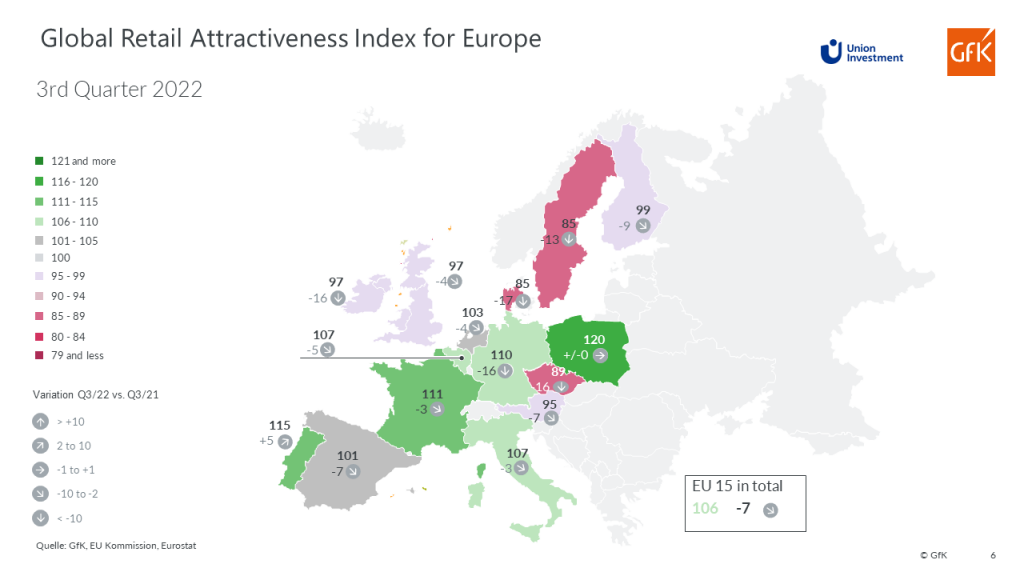

In Germany, Austria, Finland and Sweden, values fell by 15 points on average in the third quarter of 2022 compared with the previous year (Q3 2021). The EU-15 index dropped seven points overall year-on-year in the third quarter, reaching its lowest level since the first quarter of 2021 at 106.4 points (prior year: 113.4 points).

“The retail sector across the various European countries is responding in very different ways to increased challenges, but consumer sentiment has plummeted across the board in all of the 15 countries surveyed. The upswing in consumer confidence seen in the second quarter of 2022 has vanished without trace. The drop of 40 points reflects high levels of uncertainty in light of the inflation forecasts for next year,” said Olaf Janßen, head of Real Estate Research at Union Investment. The decline in the retail index is being cushioned by continuing strong labour markets in large parts of Europe and stable retail sales. A double-digit increase was recorded for both of these indicators in the third quarter (plus 12 and 10 points respectively). The discrepancy between negative sentiment on the one hand and positive metrics in terms of labour market data and actual sales in the various countries on the other is one of the most surprising findings of the latest survey.

The Portuguese retail market is a particular bright spot. Portugal was the only country in the EU-15 index to record growth in the third quarter, bucking the general trend by climbing five points. Portugal, Poland (120 points, plus/minus zero) and France (111, minus three) were the new top trio in the index at the end of the third quarter. Germany (110 points, minus 16) dropped out of the top group for the first time and now ranks in fifth place. Sweden still lags Denmark and was the worst performer with the biggest losses year-on-year.

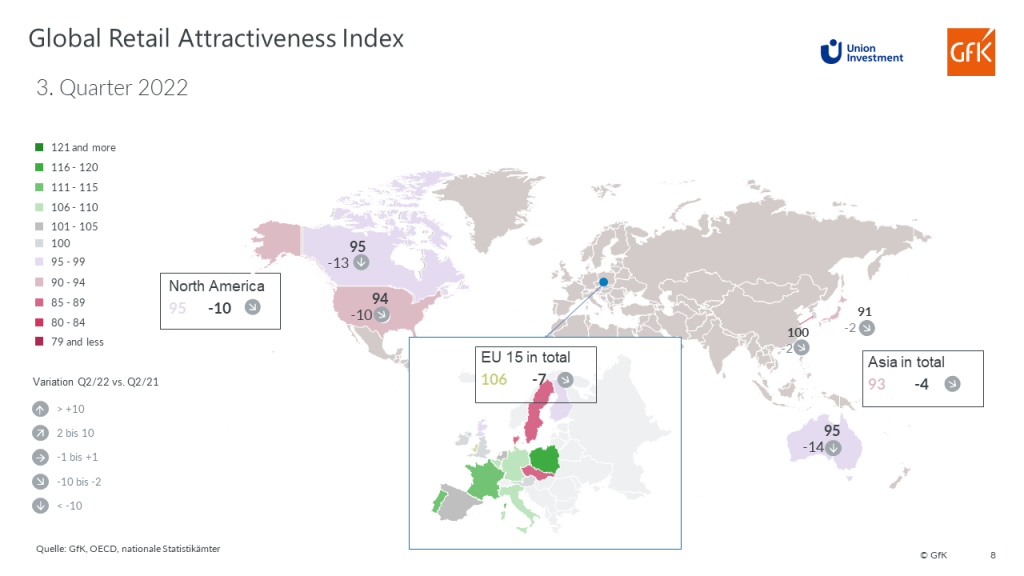

Despite these significant falls, the EU-15 index stood at 106 points and thus outperformed the indices in North America and Asia at the end of the third quarter. With slightly smaller losses than in Europe (minus four points), the retail index in Asia-Pacific was once again below average at 93 points. The North America index declined the most (minus 10 points) compared to Europe and Asia-Pacific and stood at just 95 points. The decline in North America was triggered by a marked fall in sentiment on both the business retail side and the consumer side. In Asia-Pacific, lower retail sales also contributed to the decline in the index. The biggest losses in the two non-European indices were recorded in Australia (93 points, minus 14) and Canada (95 points, minus 13) at the end of the third quarter.

Union Investment’s Global Retail Attractiveness Index (GRAI) measures the attractiveness of retail markets across a total of 20 countries in Europe, North America and the Asia-Pacific region. An index value of 100 points represents average performance. The EU-15 index combines the indexes for the following EU countries, weighted according to their respective population size: Sweden, Finland, Denmark, Germany, France, Italy, Spain, Austria, the Netherlands, Belgium, Ireland, Portugal, Poland and the Czech Republic, plus the United Kingdom. The North America index comprises the US and Canada, while the Asia-Pacific index covers Japan, South Korea and Australia.

Compiled every six months by market research company GfK, the Global Retail Attractiveness Index consists of two sentiment indicators and two data-based indicators. All four factors are weighted equally in the index, at 25 per cent each. The index reflects consumer confidence as well as business retail confidence. As quantitative input factors, the GRAI incorporates changes in the unemployment rate and retail sales performance (rolling 12 months). After standardisation and transformation, each input factor has an average value of 100 points and a possible value range of 0 to 200 points. The index is based on the latest data from GfK, the European Commission, the OECD, Trading Economics, Eurostat and the respective national statistical offices. The changes indicated refer to the corresponding prior-year period (Q3 2021).

Source : Union Investment Real Estate

Le mie ricette per la real estate community

Le mie ricette per la real estate community